All Insights

Black Ops 7 Faces Backlash as Fans Accuse Game of “AI Slop”

Call of Duty: Black Ops 7 has only recently hit the market, but...

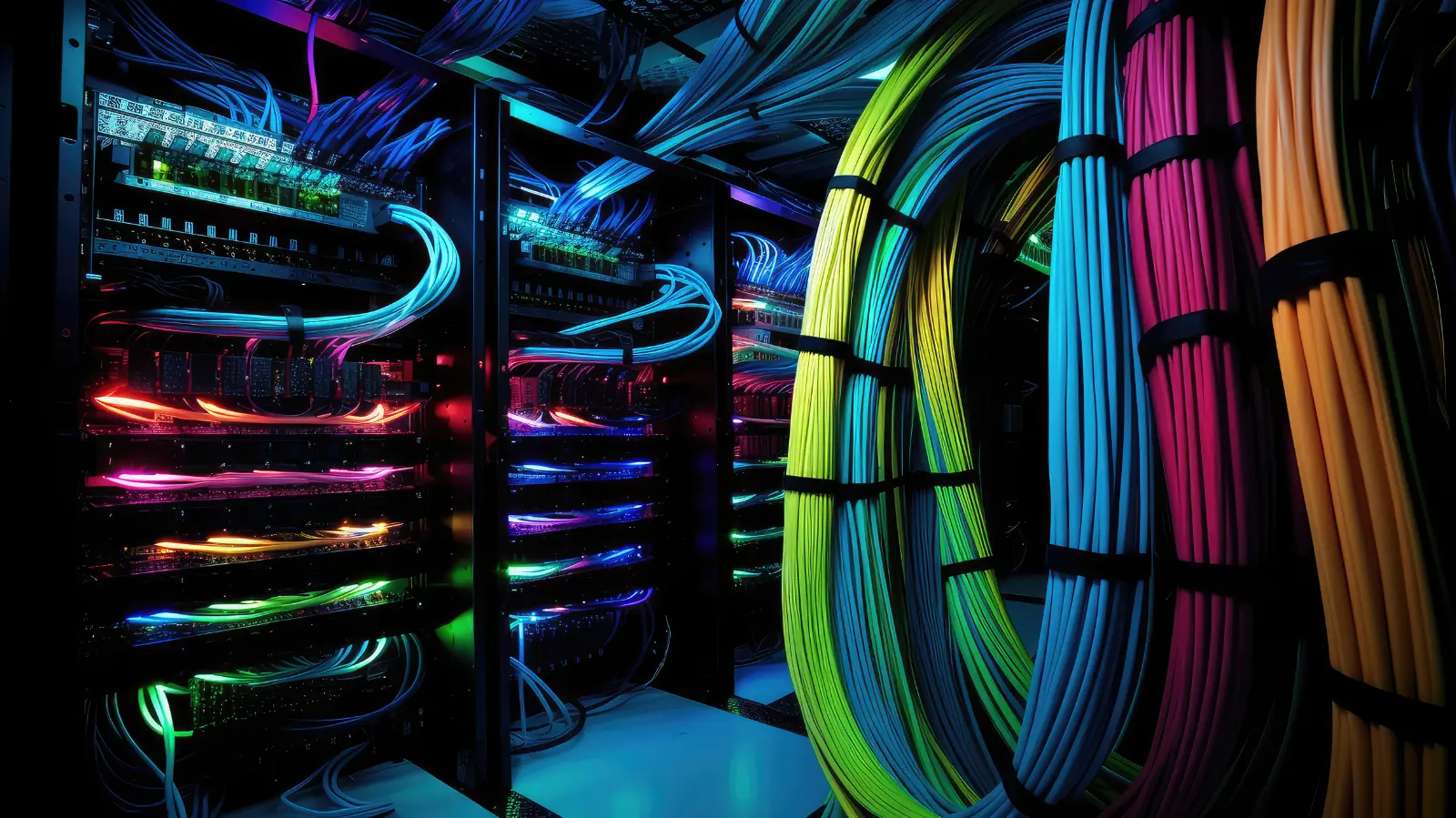

Edge Data Centers as the Next Strategic Heat Resource for Cities

Introduction Cities are about to inherit a surprising new utility: heat from the...

The Gulf’s New Dark Horse: Bahrain’s Rise in the Crypto Race

Something interesting is happening in Bahrain, and for once, it’s not tied to...

Bahrain’s New Creative Class: Artists, Gamers, Content Creators and the Emerging Digital Culture

Bahrain is quietly building a new cultural economy, one that is powered by...

Auditing the Mind: How Bias Audits Can Make Mental Health AI Fairer

When models advise on mental health care, they influence who receives therapy, medication,...

From Startup to Stock Market: Dubizzle Group’s Next Big Move on the DFM

Dubizzle Group Holdings PLC (“Dubizzle Group”), the MENA region’s leading digital classifieds marketplace,...

The Flight That Brought Bahrain Back to the World Stage

When Gulf Air’s Boeing 787-9 touched down at New York’s JFK Airport in...

The Power of Being Small: Why Bahrain’s Size Is Its Strategic Advantage

In a global economy often dominated by giants, smaller nations can be dismissed...

Bahrain’s Crypto Calling: Making the Kingdom the Gulf’s Finance Hub

On a warm September morning in Manama’s Financial Harbour, the skyline tells its...

Seabed Mining Sponsorship: Bahrain’s Strategic Leap into the Deep

Bahrain has taken a bold step by becoming the first country in the...

MYX Finance Price Explosion Sparks Debate as Smart Investors Look to Best Wallet Token

The crypto market never sleeps, and this week it gave traders another wild...

Bahrain: A Kingdom Defined by Tradition and Transformation

Introduction Bahrain stands at a unique intersection of history and innovation. Its centuries-old...

Corporate ESG Performance Improves, But Violations Are Also on the Rise

Corporate ESG Performance Improves, But Violations Are Also on the Rise A new...

What If We Treated Glaciers as Art?

Why 2025 Must Be the Year We Preserve Our Frozen Heritage The Benchmark...

Human Rights in Freefall: 2025’s Silence in the Face of Crisis

In 2025, the notion of global solidarity stands at a crossroads. While the...

Bahrain Hosts the 26th Arab Basketball Championship: A Historic First for the Gulf

Bahrain just carved out a monumental moment in regional sports history – not...

Have a question or need expert guidance? We’re here to help.

Simply fill out the form, and we’ll get back to you with tailored solutions to meet your needs.

Your next business breakthrough starts here.